Understanding Life Insurance: Common Myths, Revelations, and Insights

Navigating the world of life insurance can often feel overwhelming and sometimes a bit daunting. Many view it as a complex or uncomfortable topic, yet it remains a fundamental element of comprehensive financial planning.

Throughout my experience, I’ve encountered numerous misconceptions that can hinder individuals from making informed decisions. For example, some believe that life insurance is only necessary later in life, deem it a scam, or assume that employer-provided coverage suffices for their needs. These misunderstandings can lead to underinsurance or missed opportunities for financial security.

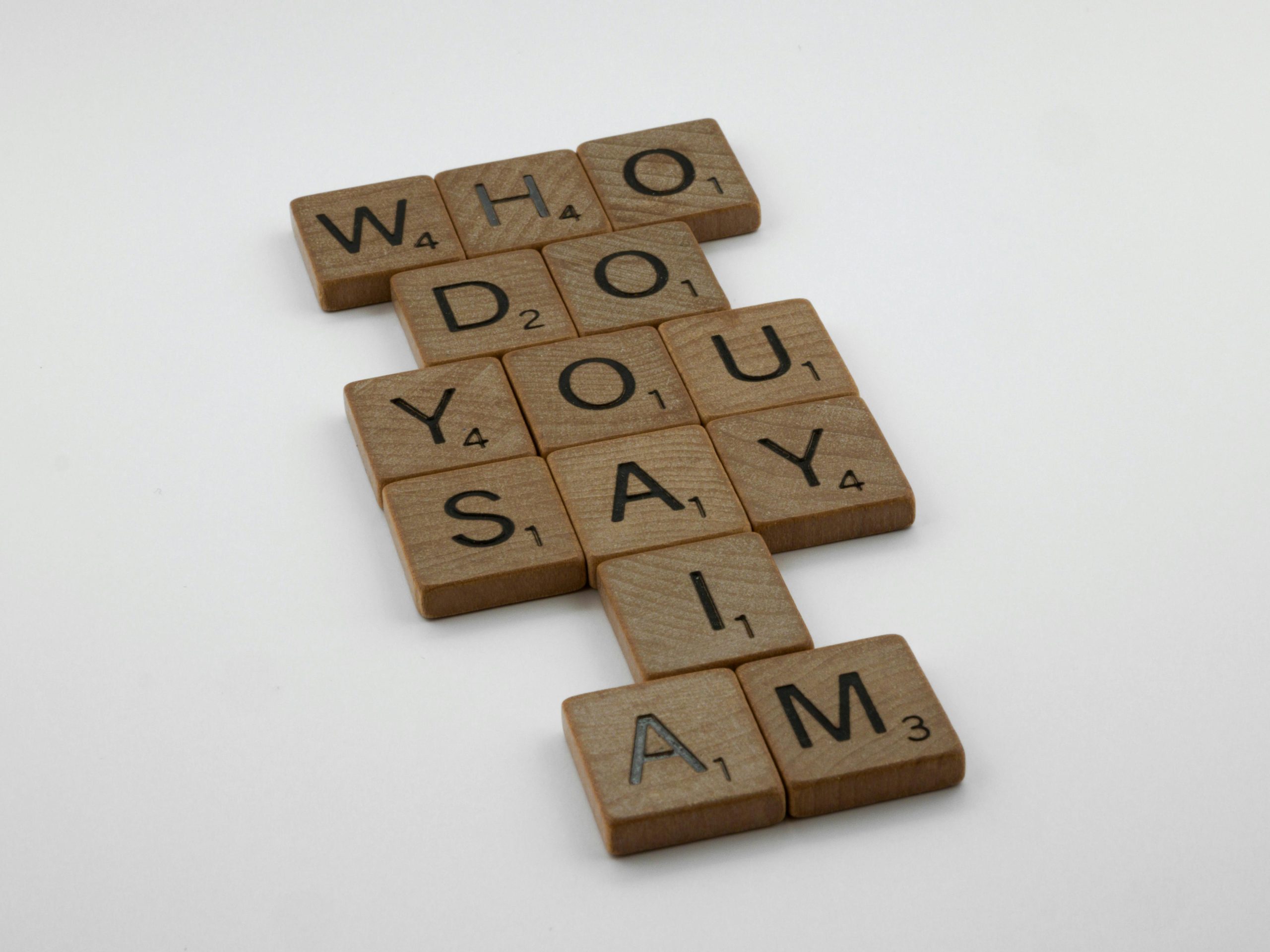

I’m interested in hearing from you:

- What was your most significant misconception about life insurance before you truly understood it?

- Can you recall an ‘aha!’ moment—perhaps a realization or piece of information—that changed how you view its importance in your financial strategy?

- Have you come across any surprising facts or insights while researching or considering life insurance?

- What are your overall thoughts on how life insurance fits into personal financial plans?

Let’s foster a helpful and informative discussion. Please share your experiences and perspectives—this is an opportunity to learn from one another, not to promote specific products. Together, we can demystify this vital aspect of financial health.