Understanding Life Insurance: Common Misconceptions and Key Insights

Navigating the world of life insurance can often feel overwhelming and even uncomfortable, as it involves contemplating our own mortality. Despite its vital role in comprehensive financial planning, many individuals hold misconceptions or simply lack clarity about its true purpose and benefits.

In my experience, I’ve encountered numerous myths surrounding life insurance, such as beliefs that it’s solely for the elderly, a scam to avoid, or that existing employer-provided coverage suffices. These misunderstandings can prevent people from leveraging a valuable financial tool.

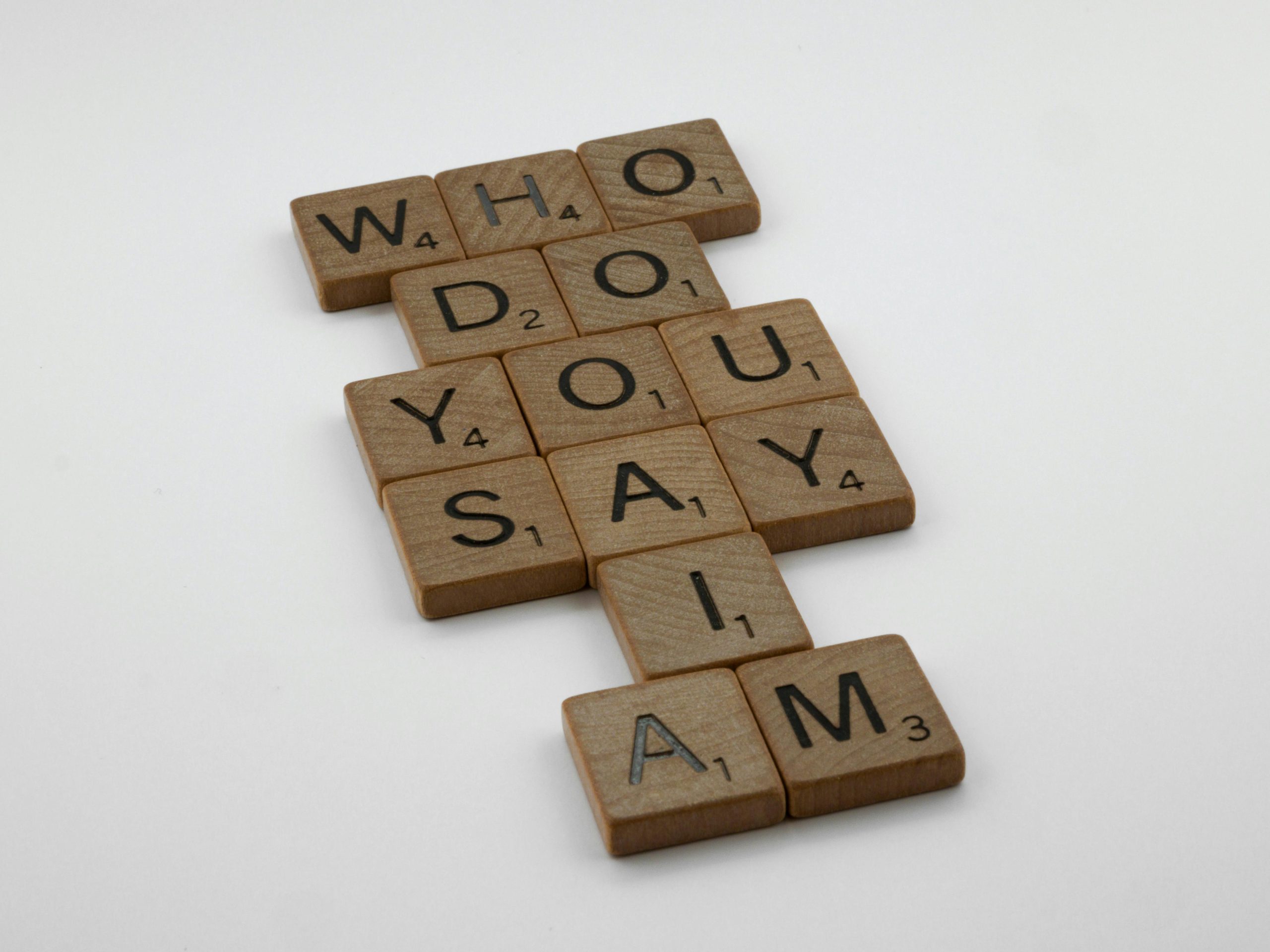

Therefore, I invite you to reflect on your own journey with life insurance:

- What was a common misconception you once believed?

- Was there an eye-opening moment that shifted your perspective on its significance?

- Have you discovered any surprising facts or benefits while researching or considering life insurance?

- How do you perceive its role within a broader personal finance strategy?

Let’s foster a constructive discussion by sharing knowledge and personal experiences. Please note, this conversation is about general understanding—no product endorsements or pitches, just honest insights to help clarify this important topic.