Demystifying Life Insurance: Common Misconceptions and Eye-Opening Realizations

Navigating the world of life insurance can often feel overwhelming, complicated, or even uncomfortable. It’s a topic that many tend to shy away from, perhaps because of its sensitive nature or due to widespread myths. However, understanding the true purpose and benefits of life insurance is essential for building a solid financial foundation.

Over the years, I’ve encountered numerous misconceptions about life insurance, from beliefs that it’s only necessary for older adults to outright skepticism about its legitimacy. Some people assume that their existing employment coverage suffices, or that purchasing life insurance is an unnecessary expense.

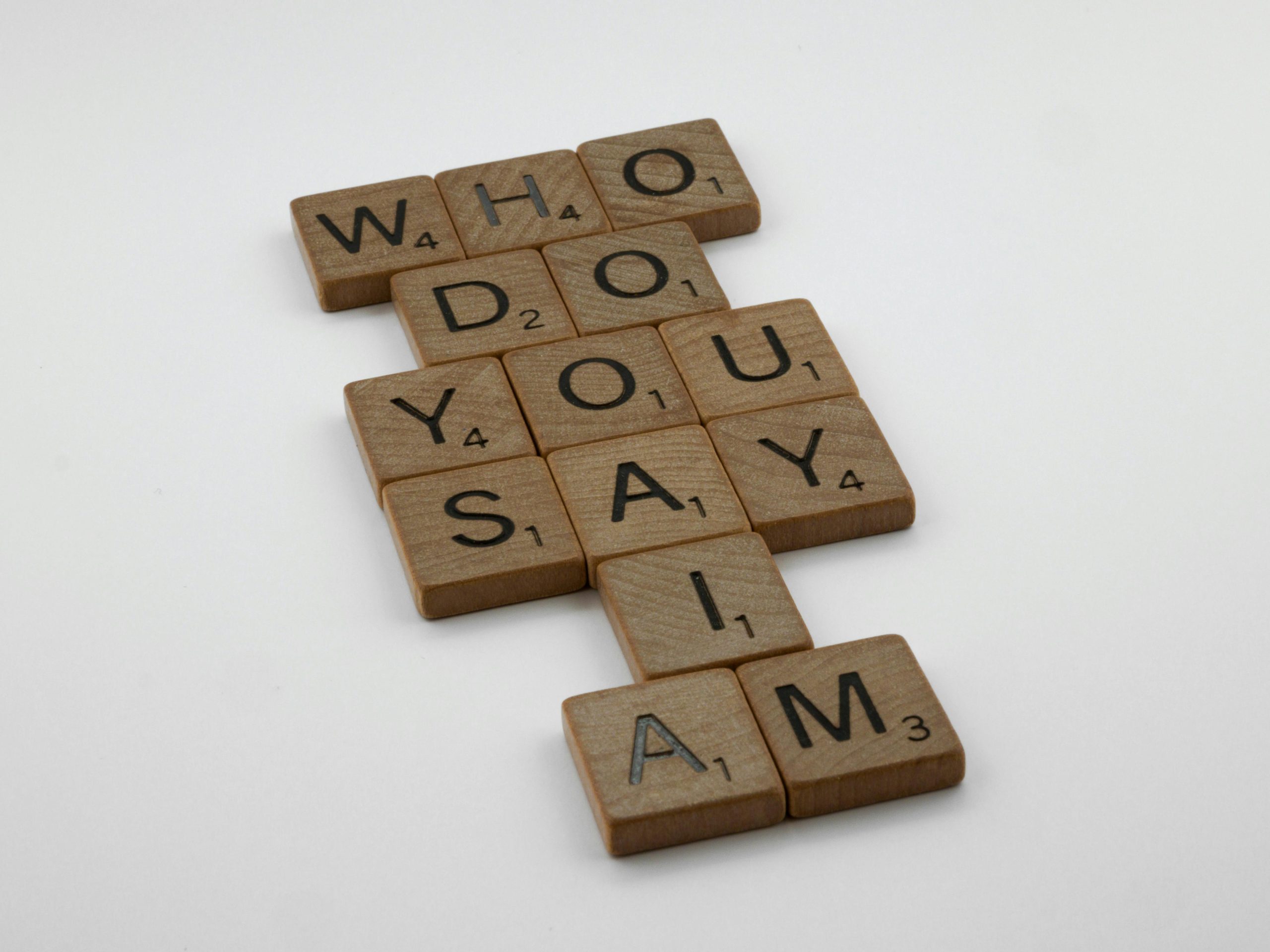

So, I’d like to open the discussion:

- What was the biggest misunderstanding you held about life insurance before you learned more?

- Was there an “aha!” moment that changed your perspective—perhaps when you realized its real value or limitations?

- Have you discovered any surprising facts or insights during your research or personal experience with it?

- How do you view the role of life insurance within a comprehensive personal finance strategy?

Let’s share our insights and experiences to foster a more informed and constructive conversation. Remember, this is about learning from each other’s journeys—no sales pitches or product endorsements, please.

Your thoughts could be just what someone else needs to break through their misconceptions and make smarter financial decisions.