Demystifying Life Insurance: Common Myths and Eye-Opening Realizations

Understanding life insurance can often seem daunting or even uncomfortable, given its sensitive nature and the complex details involved. Yet, it remains a vital component of a comprehensive financial plan—a safety net that can provide security for your loved ones when it matters most.

Throughout my journey and from discussions with others, I’ve noticed a pattern of misconceptions surrounding this essential financial tool. Some believe it’s only necessary for older adults or assume it’s a scam designed to exploit consumers. Others might think that their employer-provided coverage is sufficient, overlooking the importance of personalized policies tailored to individual needs.

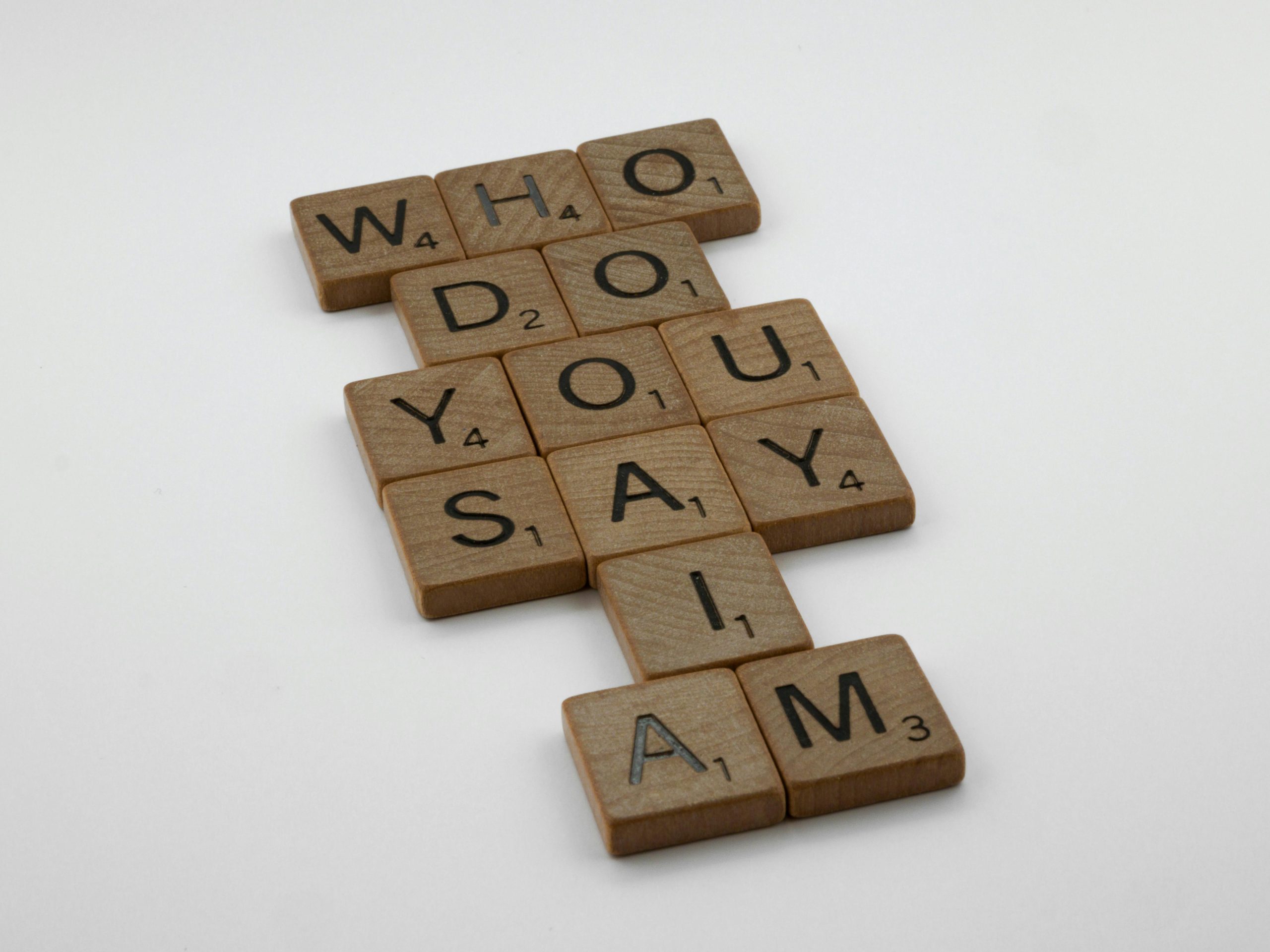

I’m interested in hearing your experiences, too. Consider these questions:

- What was the biggest misunderstanding you held about life insurance before you learned more?

- Was there an “aha!” moment that changed your perspective on its significance?

- Did you uncover anything unexpected during your research or application process?

- How do you view the role of life insurance within your overall financial strategy?

Let’s foster a thoughtful discussion—sharing insights, dispelling myths, and learning from one another. Please keep comments focused on experiences and general knowledge rather than product promotions.

Looking forward to your perspectives!