Understanding Fault Investigation in Car Accidents: What to Expect

Recently, I experienced a harrowing car accident while driving on a busy road. An individual in a sedan collided with my car on the driver’s side, resulting in extensive damage. Fortunately, I’m safe, though I emerged with some bruises and cuts, reminding me of how precarious life can be on the road.

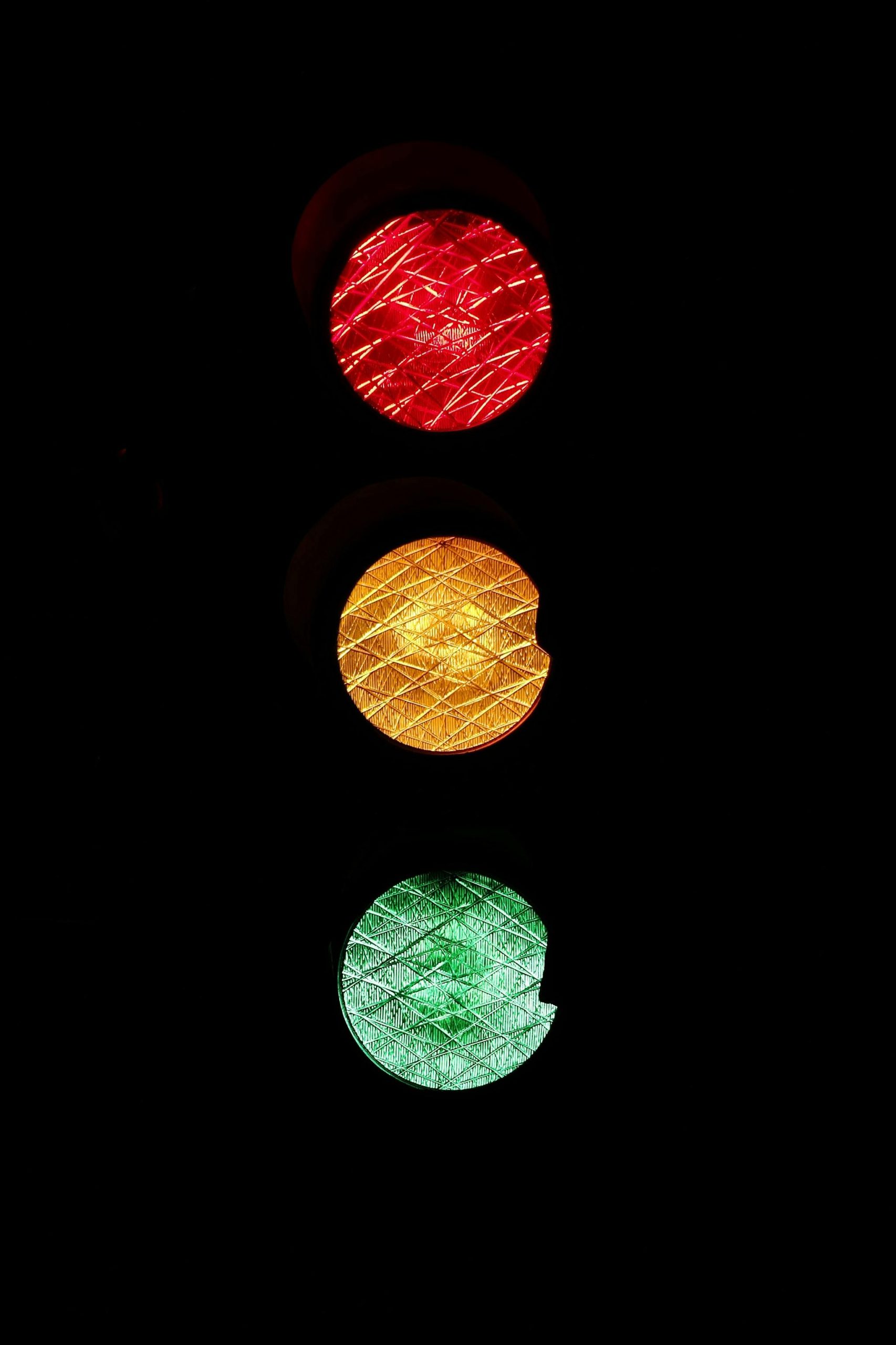

In moments like these, one can’t help but wish for that extra layer of protection—such as a dashcam to document the event. Although I firmly believe that I had the right of way with a green light, the other driver has suggested otherwise. This brings me to a critical question about the investigation process: Do insurance investigators actually verify traffic signal logs and Event Data Recorders (EDRs) during their assessments?

What Happens After a Car Accident?

When an accident occurs, especially in cases of conflicting accounts, insurance companies will look to establish fault through various means. This includes examining evidence such as:

-

Traffic Signal Logs: These records can show the status of traffic lights at the time of the incident, helping to clarify who had the right of way.

-

Event Data Recorders (EDRs): Often referred to as “black boxes,” these devices collect information about the vehicle’s operation leading up to a collision. This data can provide crucial insights into speed, braking, and whether safety measures were deployed.

Navigating the Claims Process

While dealing with the aftermath of an accident, it’s important to be mindful of how you present your account. My sister advised that I keep my statement neutral, stating simply that I was driving when the other vehicle struck mine. This advice is prudent; being factual and concise can help in building a strong case.

What Should You Do Next?

-

Collect Evidence: If possible, gather any witness statements, photographs of the scene, or diagrams illustrating the accident. This can provide additional context to your situation.

-

File Your Claim Promptly: Ensure you submit your claim to your insurance company as soon as possible. Include all relevant details without assigning blame prematurely.

-

Follow Up on Investigation Processes: Don’t hesitate to ask your insurance provider whether they will be reviewing traffic signal logs or EDR data. Knowing how they arrive at a decision can ease your mind during this stressful time.

-

Seek Professional Advice: If you are feeling overwhelmed, consider consulting with a legal professional who specializes in auto accidents. They