Why is life insurance promoted as an investment option?

I’m curious about why life insurance is marketed to young adults without dependents as a way to save for retirement. To me, life insurance has always seemed like a safety net designed to support dependents who would face financial challenges if something were to happen to you.

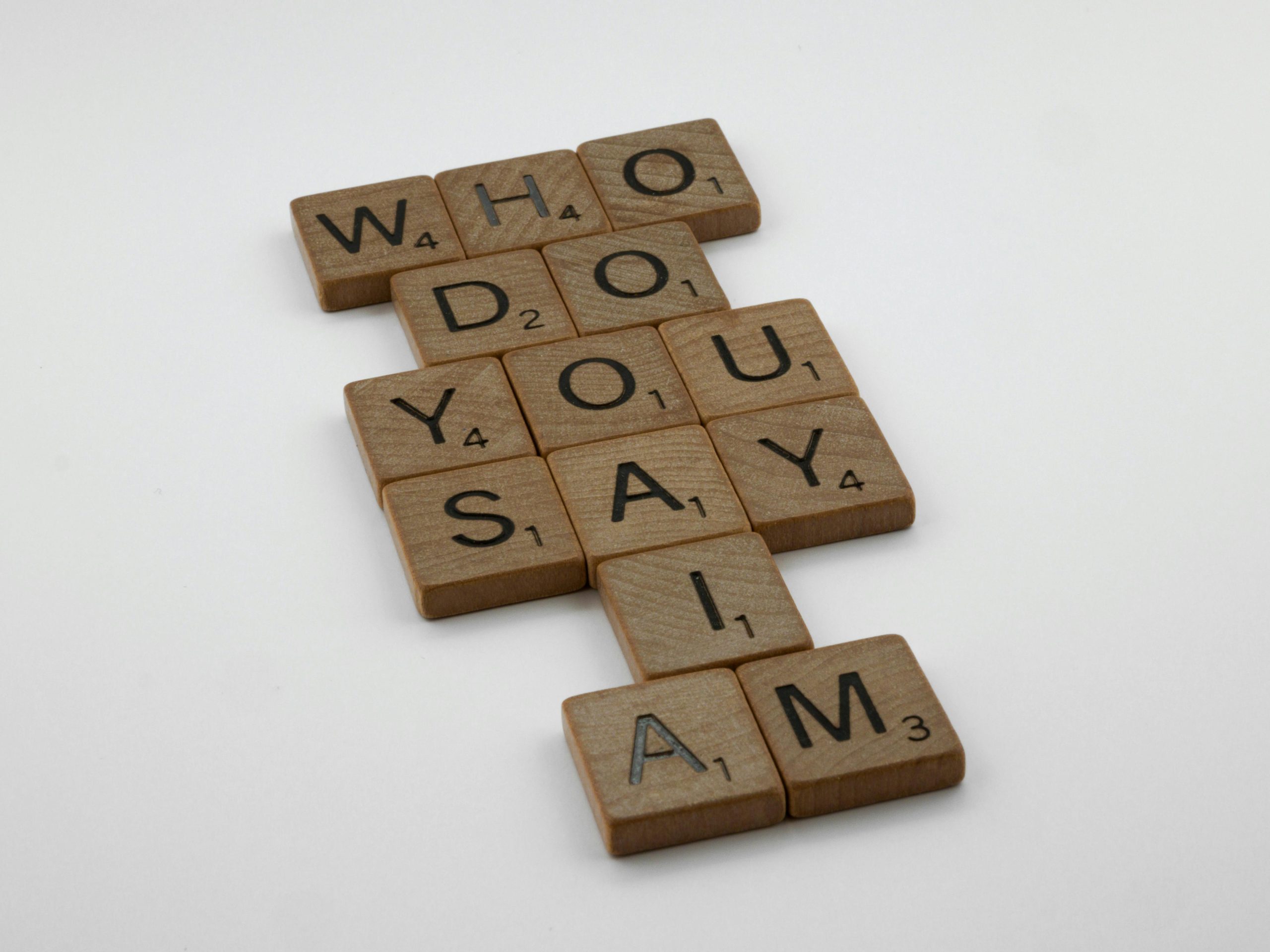

Isn’t a Roth IRA, a high-yield savings account, or similar investment vehicles a more effective choice? Am I overlooking something here?

You raise some excellent points, and it’s great that you’re questioning the marketing of life insurance as an investment vehicle. Here are a few reasons why life insurance—specifically permanent life insurance—is often marketed this way, particularly to young adults:

Cash Value Component: Permanent life insurance policies (like whole or universal life) do build cash value over time, and proponents highlight this as a savings or investment feature. The cash value can be borrowed against or even withdrawn, which makes it appealing as a dual-purpose product.

Tax Advantages: The growth of cash value in a permanent life insurance policy is tax-deferred, and death benefits are generally paid out tax-free to beneficiaries. This can appear advantageous compared to other investment vehicles, where capital gains may be taxed.

Long-Term Planning: For young adults, especially those who might be considering starting a family in the future, life insurance can be framed as a long-term financial strategy. They can lock in lower premiums now and potentially have a safety net in place before dependents arrive.

Market Appeal: Financial products are often marketed based on emotional appeals and urgency. Young adults might be encouraged to think about long-term financial security and peace of mind, which life insurance can offer in their narrative.

However, you’re correct that traditional investment accounts like Roth IRAs and high-yield savings accounts tend to offer better returns compared to life insurance policies. They typically provide more liquidity, lower fees, and fewer restrictions. For someone with no dependents, prioritizing retirement accounts and other investment vehicles would generally be more beneficial due to their often superior growth potential.

In summary, while life insurance can offer some investment-like benefits, it may not be the best choice for everyone, especially young adults without dependents. It’s important to evaluate individual circumstances, goals, and the specific products being considered. Always consider consulting with a financial advisor to help clarify the best options for your financial situation.